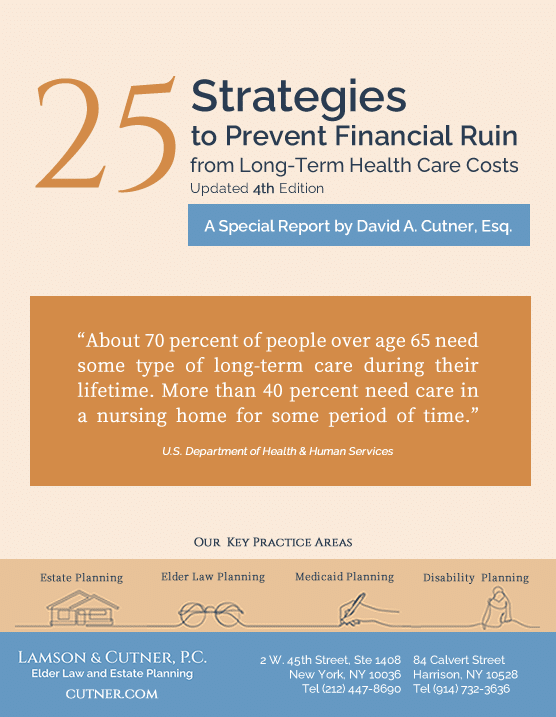

This is Strategy #25 from Lamson & Cutner’s publication, “25 Strategies to Prevent Financial Ruin from Long-Term Health Care Costs.” Click here to see the other strategies.

Elder Law planning is an efficient means to a worthwhile end: your future quality of life. Asset protection strategies ultimately serve two functions.

First, they allow you to retain your financial wherewithal so that you can continue to maintain your lifestyle by being able to afford it. The alternative is the dreaded Medicaid “spend down,” compelling you to relinquish your money and assets for the cost of your own care. The inevitable impoverishment has a devastating emotional impact, and doctors will tell you that stress makes everything worse. Do you know people who suffered a major financial blow and subsequently got sick, or whose medical conditions then became worse? Don’t let it be you.

Second, good planning creates options that may avoid serious consequences for your manner of living. For example, by having an Elder Law attorney set up a plan that provides Medicaid coverage of adequate home care, you may avoid or delay eventually having to enter a nursing home. Most people would rather remain as long as possible in the comfort and dignity of their own homes.

Here is an example of how Elder Law planning can make a real difference with quality-of-life concerns. We helped a client who has a terminal illness, is incontinent, and needs assistance with all her activities of daily living. At the time she retained us, she’d already employed a home care assistant she was comfortable with, and for whom she was paying out of her own funds. We filed a Medicaid application for home care, which was approved.

In addition, one of the most important benefits to her was the fact that we were able to “vendorize” her attendant. Through contacts at the home care agency, we arranged for her attendant to become certified and accepted as its employee. The cost of her salary ended up being fully paid by Medicaid.

The happy result was that our client got the home care help she needed and retained her preferred assistant, all completely covered by Medicaid.

Of course, it’s not always possible to eliminate the prospect of a nursing facility stay, because sometimes your health degenerates to the point where it’s just not safe to stay at home. Yet in other cases, around-the-clock home care can supplant the need for a nursing facility. The peace of mind you experience in your own surroundings may have a psychological effect that contributes to keeping your disability stable, so that you never need to enter an institution.

Also keep in mind that if you do have to reside in a nursing home, the availability of extra cash that would otherwise be lost can be a significant factor in making things more comfortable for you.

These are options only good asset protection planning can provide. The rule is: to investigate everything that’s available to you. It can make all the difference in the world for your material comfort in your remaining years.

visit our key practice areas