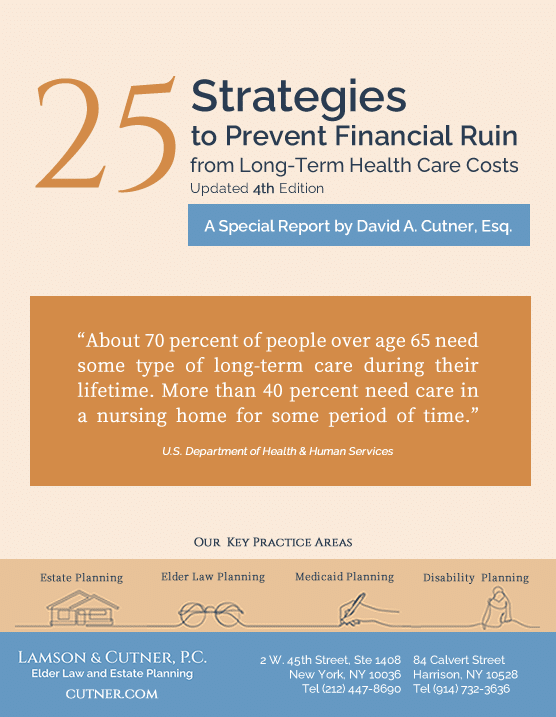

This is Strategy #11 from Lamson & Cutner’s publication, “25 Strategies to Prevent Financial Ruin from Long-Term Health Care Costs.” Click here to see the other strategies.

Medicaid will count your IRA or 401k as an available source of funds to pay for your care unless it is in payout status. “Payout status” means that you are taking at least the required minimum distribution out of your plan on a monthly basis or annually.

If it’s not in payout status, it may be beneficial to withdraw the entire amount and pay the income tax on it, and then transfer it to a trust. This avoids your retirement account being counted as a resource that you will have to “spend down” under Medicaid eligibility requirements. Instead, your money can be used for your benefit during your lifetime, and whatever is left can be passed on to your beneficiaries through the trust.

If the account is in payout status, your retirement assets are not counted as resources, but the monthly payments that you receive are considered income. If you are receiving Medicaid home care benefits, any excess income can be protected by a Pooled Income Trust (discussed in Strategy No. 9). However, if you’re getting Medicaid nursing home benefits, the nursing facility is entitled to all of your monthly income except $50.

If you are receiving Medicaid benefits in a nursing home and your life expectancy is not very long, it may be to your children’s financial advantage to leave the retirement plan in payout status and allow the nursing home to collect the income from your IRA or other plan while you are still alive. Upon your death, your children, as your beneficiaries, can withdraw the balance in a lump sum or over time.

As you can see, finding the best solution for retirement assets demands careful analysis.

visit our key practice areas