This is Strategy #1 from Lamson & Cutner’s publication, “25 Strategies to Prevent Financial Ruin from Long-Term Health Care Costs.” Click here to see the other strategies.

Many people have the false impression that Elder Law planning is not worth investigating, because they think they are not eligible for Medicaid. They feel they have too much money, income, and other assets to qualify, or believe that some of the specialized trust strategies used for asset protection are for rich people only. This is simply untrue. In fact, the people who are not millionaires are often the ones who benefit the most from this planning. They are the ones who most need to use the assets they have saved to maintain their lifestyles, without a large cushion.

With effective planning, most can qualify for Medicaid benefits. Elder Law strategies allow you to protect your home if you own one, and the monetary resources you’ve built up over a lifetime. The alternative is to deplete your reserves paying for your own care, which Medicaid would otherwise cover.

Additionally, many people who could be eligible for Medicaid payment of home care or nursing facility programs think they will be blocked by the “look back” and “penalty” periods. This results from a faulty understanding of these terms, which are explained in detail in this report. In New York, until at least March 31, 2024, the look back and penalty period apply only to nursing home applications.

Even with these limitations, in many instances, you can be approved by Medicaid for community or nursing facility care and have it fully paid. And even if you need nursing home care, and are subject to a “penalty period,” there are often steps you can take to protect a significant portion of your savings.

It pays to sit down with an Elder Law attorney and review the details of your unique situation. You may find it to be one of the best things you’ve ever done for yourself and your family. You get to retain the benefit of your savings, income and assets, and maintain your quality of life. When you pass on, it’s a great gain for your family members who will inherit what would otherwise be lost to the cost of your care.

If you’ve applied for Medicaid and have been denied benefits, it’s quite possible to have the decision reversed. There are many reasons for a denial and a variety of strategies for addressing them. Common reasons include excess assets, lack of documentation, improper transfers, or spousal issues. An experienced Elder Law firm can help with these roadblocks, and in many cases successfully initiate procedures to qualify you. Often, it is simply a question of correctly implementing the methods described in this report.

Be proactive in pursuing government benefits you’re entitled to, and to which you have contributed with your tax dollars.

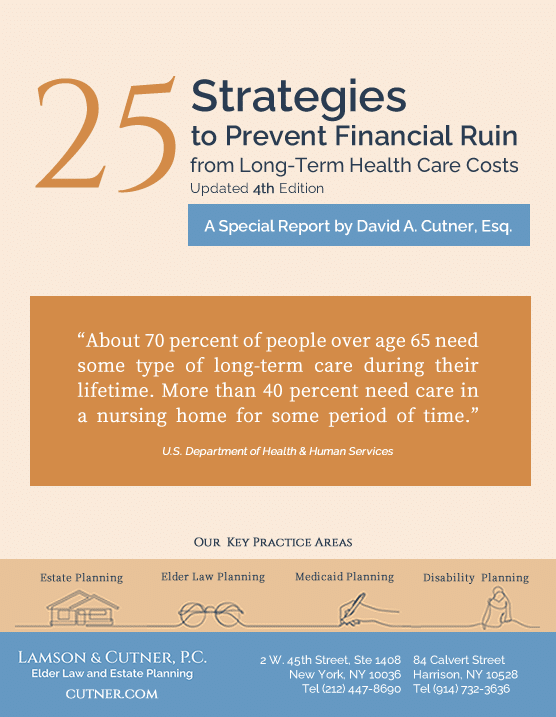

visit our key practice areas