Unlike Medicare, which is available to almost everyone who attains the age of 65, Medicaid has strict eligibility standards based on financial resources or on income.

Medicaid is the one government program that pays for long-term custodial care, at home, in an assisted living facility, or in a nursing home.

Medicaid’s rules are complex. There are variety of paths to attaining Medicaid, but seniors (persons over the age of 65) will normally be required to follow the eligibility rules described below.

Many people are discouraged from looking further once they see the low Financial Levels required by Medicaid. That can be a big mistake. In New York, there are many opportunities to implement effective strategies to obtain Medicaid benefits, and to protect your assets or income at the same time. To see what you might be able to do, click on Find Your Situation in our header.

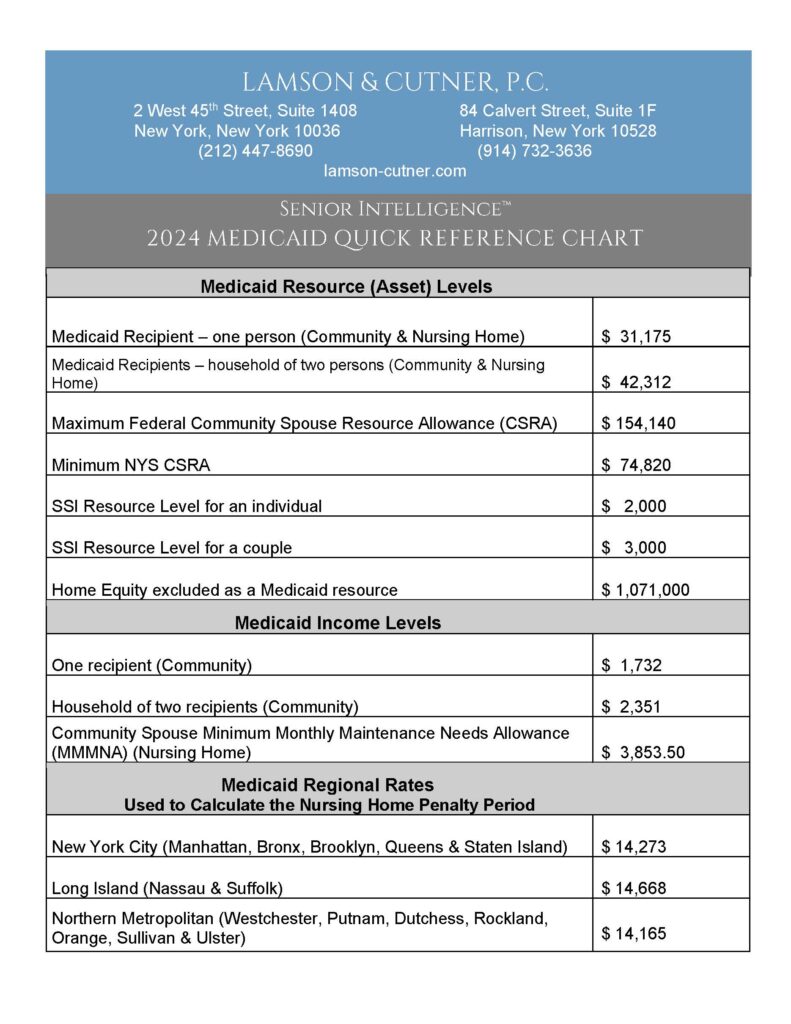

Current Financial Levels Can Be Found in the Quick Reference Chart Below

Community Medicaid (includes Home Care or Assisted Living)

A Medicaid applicant or recipient is allowed to have a small amount in total financial resources (not counting the home and certain other exempt assets). The current level can be found in the Quick Reference Chart below. New York City residents may also have a $1,500 burial account (in addition to a pre-paid funeral).

A person on Medicaid is allowed to keep a small amount in monthly income (again, the current level can be found below). Monthly income above this amount is “surplus” and must be contributed toward your cost of care, unless you have a pooled income trust.

The primary residence is not counted as a resource at the time the Medicaid application is submitted, if the home equity is below the threshold listed below. Equity above that amount will be counted to determine whether your total resources are below the threshold limit and thus, whether you satisfy the eligibility test.

Institutional Medicaid (Nursing Home)

A Medicaid applicant or recipient is allowed to have a small amount in total financial resources. Any real estate, or a co-op apartment, is counted as a resource, since it is no longer your primary residence.

Note that any transfers of money or property are subject to Medicaid’s five year “look back” and penalty rules. Click here for more information about the look back and penalty. These rules do not apply in Community Medicaid cases.

A married or non-married person residing in a nursing home is permitted to keep only $50 per month of his or her monthly income as a personal needs allowance.

Where one spouse is in a nursing home, the community spouse has a maximum resource allowance of one-half of the couple’s assets up to the Community Spouse Resource Allowance ("CSRA"), shown below. The minimum allowance is the lower figure shown below, or the couple’s total assets, whichever is less.

The community spouse of someone in a nursing home is entitled to retain up to a specified amount of the couple's combined monthly income without being required to make a contribution towards the cost of the nursing home. Again, the current level is shown in the chart. This has a real mouthful of a name: the "Minimum Monthly Maintenance Needs Allowance" (MMMNA). If the community spouse’s monthly income exceeds that amount, he or she will be required to contribute 25% of the excess.

Again, don’t be scared away by these numbers. With intelligent planning and a good Elder Law attorney, almost anyone can qualify for Medicaid. Click to Find Your Situation in the header, and discover some of the strategies that might be available to help you.

visit our key practice areas